Rough Waters: Gentrification and Cataclysmic Money

This is the third of four pieces in a series on urbanists' relationship to the hot-button issue of gentrification. By "urbanists," I mean the overlapping array of interest groups who advocate traditional forms of urban development: this includes, but is not limited to, proponents of New Urbanism, YIMBYs, transit and walkability advocates, and of course, the Strong Towns movement.

It's no secret that urbanists and urban social-justice advocates often don't speak the same language. The former think of their primary concern as the physical form of cities, the latter, the socioeconomic relations within them.

Urbanists are often frustrated that anti-gentrification activists too easily become enemies of infill construction and density, and are highly suspicious of new development in places that could benefit from it. A recent essay by Jason Segedy, the Director of Planning and Urban Development for Akron, Ohio, neatly captures this frustration:

In the eastern Great Lakes region... most of the changes that are being held out as disturbing examples of gentrification, and are provoking hand-wringing in places like Buffalo, Cleveland, and Detroit, simply amount to the return of the middle class (with a sprinkling of the truly affluent) to several small pockets of the city.

Yet, even the earliest signs of neighborhood revitalization, and nascent attempts at building new housing and opening small businesses in these cities are frequently opposed by people who are convinced that they are acting in the name of social justice.

Sincere as these anti-gentrification sentiments might be, I believe that they are harmful, and, if allowed to derail incipient efforts to reinvest in urban neighborhoods, simply serve to ensure that the existing dynamic of socioeconomic segregation will remain unchanged.

Protest banner attached by activists to a Google employee shuttle in San Francisco. (Source: Steve Rhodes via Flickr)

On the flip side, urbanists are regarded with mistrust from multiple corners. They get perceived as elitists, as niche interest groups ("spandex-clad cyclists"), or as shills for corporate developers. Grassroots YIMBY groups especially are frequently accused of being phony "astroturf" organizations cooked up by tech and development companies.

In the worst cases, in cities where neighborhood change is most profound and threatening, this mistrust leads to perverse alliances. San Francisco is the preeminent example of this: a city where well-heeled, mostly white, homeowners and poor, mostly non-white, renters are united in the belief that what they need to do to save their city is to put up walls against invading forces.

The siege mentality that can pervade both sides of this discourse is stifling. Urbanists, instead of dismissing gentrification concerns as another face of NIMBYism (they're not), must articulate an affirmative agenda of a "gentrification-proof" city. This means a city in which new investment in the built environment generates real wealth, and in which that wealth is equitably shared, including with those who have been systematically excluded from enjoying it in the past. It means a city in which renters and homeowners alike have meaningful stakes in the places where they live.

In Part 1 of this series, "Gentrification or Economic Exclusion," I described how semantic battles over what "gentrification" means and whose experience qualifies often miss the point, and result in smug dismissals of the very real problems faced by poor people in poor neighborhoods. The relevant fact is that marginalized people tend to be excluded from economic opportunity whether or not their neighborhoods are gentrifying in some particular sense.

Not only that, but the experience on the ground in persistently poor neighborhoods checks many of the boxes associated with media coverage and popular understandings of gentrification:

- Extremely high rates of involuntary displacement / housing insecurity

- Rising rents as a cause of such displacement

- Lack of investment in the built environment—and what highly visible investment occurs is not initiated by longtime residents, is not responsive to their desires, and often does not benefit them

- Lack of community ownership; a sense that predatory outsiders are "colonizing" the neighborhood for profit (whether or not they're moving into it themselves)

Of course people in Buffalo and Cleveland and Detroit are worried about gentrification — what they experience every day is akin to what they read about people in Brooklyn and Seattle and Austin experiencing. If your first impulse is to give them a lecture about how what their neighborhood really needs is more development, you have missed the point. You haven't heard what they're asking: "How will we benefit?"

In Part 2, "Who Benefits From Neighborhood Improvements?", I discussed how gentrification critics in cities still dealing with pervasive poverty and disinvestment are correct in another sense: the decay of their neighborhoods is not unrelated to gentrification, but is in fact part of a process of which gentrification is the flip side. Disinvestment in a neighborhood over decades creates the conditions for exploitation of the rent gap: the gap between the potential value of development on the land and the value currently being realized. This exploitation is a second round of profit-taking on the land, and those windfall profits very rarely fall to the people who have been living there through the lean years.

Both parts of the cycle involve economic exploitation with little upside for the poorest residents — so again, this is what you should hear when you hear anti-gentrification rhetoric. It's not, "We don't want our neighborhood to improve." It's, "We want a controlling stake in it. We deserve to benefit this time." And they're right.

Gentrification as a Symptom of a Distorted Development Model

We talk about neighborhoods as though their fates are independent of each other, and as though decline and gentrification are opposite problems instead of two sides of a coin. This is clear in a lot of urbanist language, such as Joe Cortright's statement at City Observatory: "Concentrated poverty is a bigger problem than gentrification." The point made is valid and important. But that either-or wording elides a vital piece of the story.

It's more instructive to think of both concentrated poverty and gentrification as symptoms of a deeper distortion in the way we finance development and the public policies we use to direct and encourage it. The form of any city tells you a lot about the economic ecosystem that produced it. When downtown Cleveland sprouts new high-rises, the nearby Ohio City neighborhood sprouts microbreweries, and much of the rest of Cleveland sprouts weeds around abandoned homes (15,000 and counting), it's obvious that many Cleveland residents are poorly served. What kind of economy is doing this?

Exaggerated disinvestment-reinvestment cycles — of which gentrification is the reinvestment phase — happen because we've engineered them into our real-estate markets through policy and financing mechanisms that prioritize what Jane Jacobs famously called "cataclysmic money" over "gradual money." Incremental reinvestment is an endangered species in the American city. More often, it's a trickle or a fire hose. Take your pick.

Neighborhoods that can't sustain steady, gradual reinvestment are sooner or later going to be subject to destabilizing change, whether that change looks to you like gentrification or something else. No matter where a neighborhood is in the real-estate cycle — decline, stagnation, or rebound — it can benefit from a policy agenda that emphasizes incremental rather than cataclysmic change, financial and political stakes for local residents, and stability and security for individuals.

Urbanists have a big stake in this, too. Don't like the sterility of new "superblock" development, monocultural neighborhoods full of people who look alike and have similar incomes, or the loss of distinctive local businesses and a sense of place? These, too, are symptoms of a set of financial and policy incentive structures that prioritize "big-ness," and create fragility and volatility in the long term. If urbanists talk more about these things, they can find common cause with the social justice crowd.

We should be spending less time arguing about what gentrification is or whether it's happening in a given place, and more time talking about how to "gentrification-proof" neighborhoods. That is, how to make them places where local residents both drive the organic, gradual evolution of the place and are the primary beneficiaries of its improvement.

Understanding the Problem: Artificial Volatility and the "Big-Ness" Bias

Decline is a precondition for gentrification. It's a consequence of perverse incentives that exaggerate the cycle of neighborhood decline and reinvestment by preventing many incremental improvements. This phenomenon takes two closely related forms: artificial volatility in neighborhoods' fortunes over time and a bias toward "big-ness" in who gets to participate or have a stake in development.

The rent-gap cycle begins with a long-term decline in a neighborhood's prosperity. This is exacerbated by a lack of incremental upkeep and improvement of properties. Buildings age and lose value. A once-swanky neighborhood may become low-income and perceived as undesirable. The location retains its inherent advantages—land, after all, is the one thing they're not making more of. But redevelopment, when it finally occurs, takes the form of radical transformation rather than slow evolution, because the neighborhood has declined to the point where unlocking its intrinsic potential, to developers, means replacing, not building on, what's already there.

The Rent Gap theory, as described by Neil Smith.

Why aren't people incrementally upgrading these buildings? Putting on additions, adding second stories, growing up and out as they can afford to? This used to be the way we did things.

The disinvestment that mires a neighborhood in deep, concentrated, generational poverty isn't the "natural" state of things, it's a sign of an economic ecosystem that has been disrupted, in these and other ways:

- Starting in the 1930s, redlining by mortgage lenders, using rules created and sanctioned by the federal government, turned off the spigot of capital for incremental upkeep and improvement of properties in urban neighborhoods. It was simply impossible to get a loan in a "hazardous" area, which often just meant somewhere that non-white people lived.

- The Federal Housing Administration also refused to insure mortgages for typical urban building types, such as a mixed-use building with an apartment above a storefront.

- Massive top-down freeway investments physically eviscerated urban neighborhoods and sucked wealth out of them, while turbo-charging a middle-class exodus to suburbia.

- A wave of downzoning occurred (particularly in the 1970s) as homeowners with a siege mentality tried to stem the looming economic decline of their neighborhoods by prohibiting multifamily housing. This had the effect of locking many urban neighborhoods in amber. These places may now be expensive and desirable, but the obstruction of gradual change has been institutionalized. Many forms of incremental reinvestment remain outright illegal.

- Newer neighborhoods are built to a finished state. From there, all they can do is decline.

One big consequence of all of this is the increased residential segregation of Americans by income — the sorting of neighborhoods into poor and rich ones. To sustain a diverse neighborhood, you need buildings of varied types and ages at varied price points (the core of one of Jane Jacobs's most famous insights, that "new ideas need old buildings"). Instead of Jacobs's ideal eclectic neighborhoods, we have created development monocultures. And in a monoculture, investment is an all-or-nothing switch.

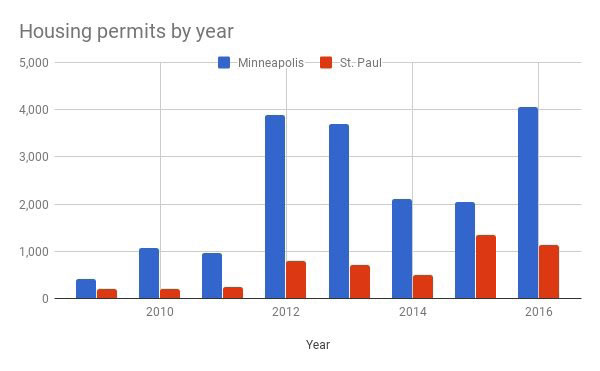

Bill Lindeke at Streets.mn recently posted a startling chart (via Scott Shaffer) of housing starts in Minneapolis versus St. Paul. The two Twin Cities are close in size (about 400,000 inhabitants in Minneapolis, about 300,000 in St. Paul). They have a similar building stock of similar age; similar demographic profiles; similar incomes... So what gives?!

The answer, I suspect, is not that all of Minneapolis is trendy while all of St. Paul is being left in the dust. Rather, it's that very few Twin Cities neighborhoods are seeing significant new housing at all, and those few just happen to be in Minneapolis right now. Check back in a few years when the redevelopment of St. Paul's 135-acre former Ford plant site (slated for up to 4,000 new units) is underway, and that chart will look very different.

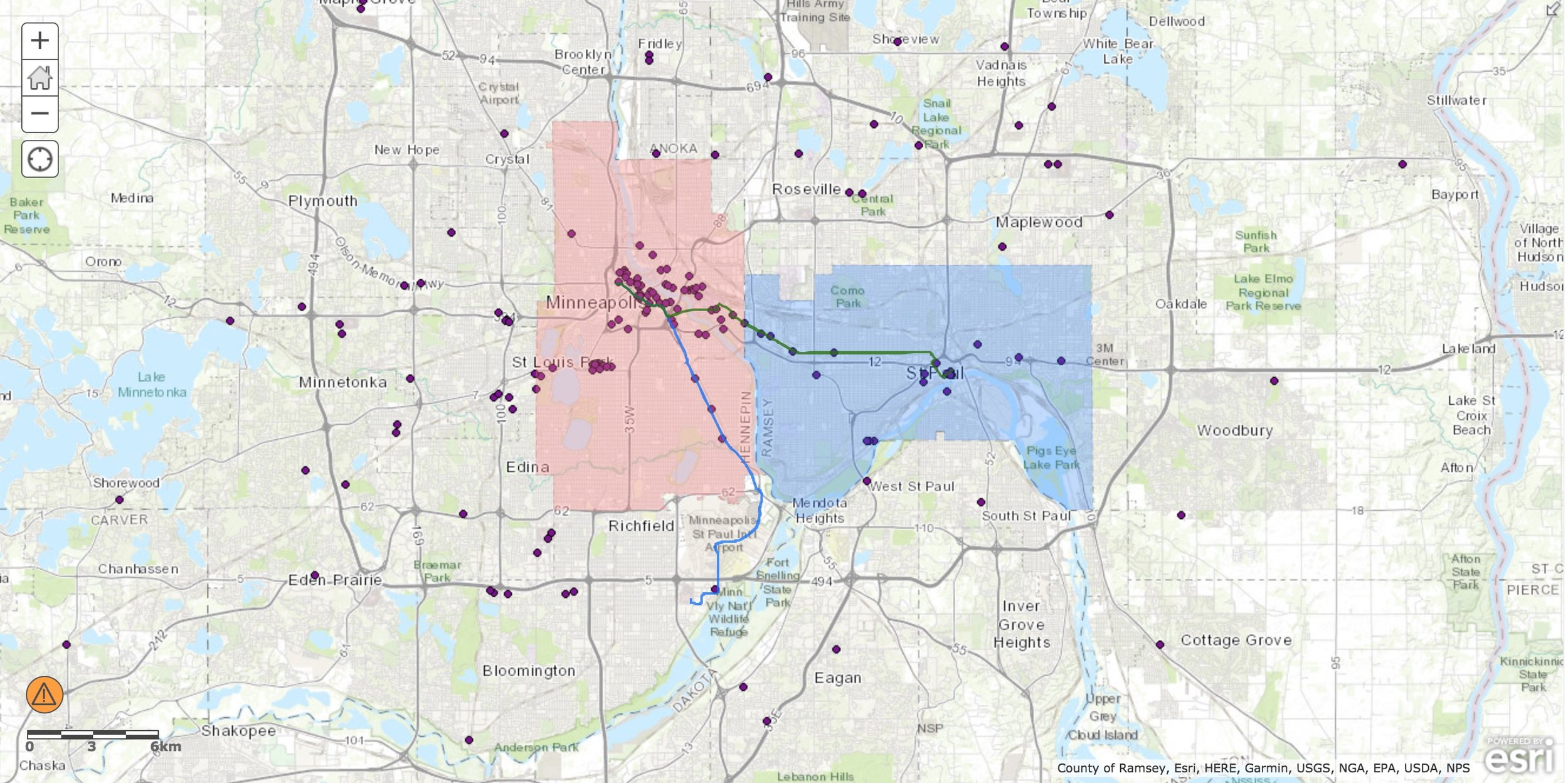

A look at the locations of residential building permits in the Twin Cities area confirms the heavily concentrated nature of infill development. Below are some maps of building permits from 2009-2016 in the Twin Cities, with Minneapolis (pink) and St. Paul (blue) highlighted. I've also marked the region's two rail transit lines to show the concentration of larger projects along them.

Here's all residential building permits (most of these are single-family homes):

The "clustering" of development begins to be apparent as soon as you filter out single-family homes. The below map shows all permits for 2 or more units (i.e. everything but single-family detached). Note that the densest hot spots for development are all in Minneapolis.

Here's all permits for 3 to 19 units (what's often called "Missing Middle" housing):

All permits for 20 to 99 units. You can see these clustered along rail corridors and near downtown Minneapolis.

And finally, permits for 100 or more units:

In the Twin Cities, as in most metro areas, Missing Middle development is comparatively scarce in favor of single-family homes and very large projects. And those large projects concentrate in only a few neighborhoods. Big developers pick winners, swarming to the neighborhoods where the profit is. And nobody else can afford to be in the game. The cost and complexity of permitting and regulatory compliance favor the big guys. And the zoning code often won't allow would-be bootstrappers to enter the game at a level of incrementalism (say, a duplex conversion, or an accessory dwelling unit) they can afford.

Anti-gentrification rhetoric can take on the tone of conspiracy theory: developers and politicians in cahoots, scheming to drive low-income people out of their neighborhoods. Of course, sometimes the targeting of the next neighborhood to be hit with cataclysmic money is explicit. A surefire sign is the "rebranding" games that the real-estate industry plays, which are simultaneously spoofed and celebrated in this shockingly tone-deaf advertisement for Indianapolis's Fall Creek Place:

It was once an unseemly place filled with unholy habitats and vice lords. Thusly people banded with bureaucrats and rebranding Oracles who ordained Dodge City be henceforth and forever known as Fall Creek Place.

Indianapolis, by the way, is one of those Rust Belt cities in which I've heard urbanist types insist that housing is cheap and gentrification is not a problem. Small pockets are getting wealthier, but much more of the city is mired in concentrated poverty, with still-declining home values and incomes. So maybe nobody is being pushed out of the Indy metro area entirely by housing prices. But the situation of Fall Creek Place is still illustrative as to what is going on, even in Midwestern cities with cheap housing, that gentrification's vocal critics have every right to be concerned about.

Historic homes on the North side of Indianapolis, where Fall Creek Place is located. (Source: Wikimedia Commons.)

Fall Creek Place is an award-winning project. It's been lauded by HUD, the American Planning Association, and the National League of Cities for its success in bringing a neighborhood back from severe blight, with help from a $4 million HUD grant in 2001. But it's also a neighborhood that was predominantly African-American and poor, and is now predominantly white and wealthy, in a city whose African-American population hasn't gotten less poor or less segregated. Fall Creek Place's transformation was juiced with a large infusion of private and government capital. Neighborhoods not far from it remain starved of resources and plagued by vacancy and decay.

Fall Creek Place is a textbook example of the ability of cataclysmic money — large increments of capital under the control of large actors — to radically transform a neighborhood. If we want pretty urban places that are nice to walk around, it's a success story. If we want equitable development, though, it's not a model to emulate. Too often we are still incapable of conceiving of neighborhood reinvestment that isn't done in this sort of big-money way by developers with a capital D.

And to say that is not to mourn what the neighborhood was at its low point (when it was nicknamed Dodge City as a nod to its "Wild West" crime rates), or to insist that it should have remained that. It's simply to observe that we could replicate the Fall Creek Place story 100 times throughout the Rust Belt, and it might not make a dent in poverty, segregation or economic exclusion.

London School of Economics sociologist Michael McQuarrie, in a comment on this Shelterforce piece, describes the game of Whack-a-Mole that is the ultimate outcome of trying to combat concentrated poverty this way, by closing the rent gap one neighborhood at a time:

The problem with policy that focuses exclusively on real estate values is that if it is not implemented alongside increases in private investment that yields higher incomes it basically only comes by shifting people around on the metropolitan map [emphasis mine]. This is effectively population churning that will inevitably benefit people who are well situated to take advantage of such policies (people with resources, people who have experience with housing markets, people who understand market and credit risk, in short, affluent people).

This context helps justify the concern people have that large influxes of public investment serve to "target" a neighborhood for gentrification.

It's not just that this targeting jump-starts the cataclysmic money waterfall into one neighborhood. It also saps up limited market demand region-wide and may prevent gradual money from seeping into other neighborhoods.

In a simplified sense, a region can support a finite amount of development. That amount is a function of population growth, economic growth and thus spending power — things that are driven by macro forces and hard to affect with local policy. When government "picks winners" and incentivizes development at key locations, permitting enough new housing in those locations to suck up nearly all of that regional demand, it creates a speculative environment that is really unhealthy. Chuck Marohn has written about that in Portland.

An all-or-nothing development environment creates a built-in bias toward big actors who can weather wide market swings and are in a position to exploit them for profit. This exacerbates inequality, as those with less access to credit are likely to get in near the top of the market, if at all. (Here's an incisive take from City Observatory on this phenomenon, a crucial reason the latest housing bubble and crash served to deepen wealth disparities between whites and non-whites.)

Think of it like the surface of a pond. In relatively placid water, reeds can take hold, and a complex wetland ecosystem can arise and thrive. In turbulent water, nothing delicate is going to grow.

In a healthy neighborhood economic cycle, the waves over time would be small as some properties age and decline while others on the same streets are upgraded in incremental ways:

In an unhealthy cycle, the kind we have engineered through our regulatory and financial mechanisms, the waves are much bigger and more destructive. The neighborhood may go through decades of decline and disinvestment, followed by a rapid flood of cataclysmic redevelopment. And poor residents will be the losers in both phases.

We need to calm the waters.

The final part of this series, which will be published in a couple weeks, will address some concrete policy mechanisms to do so — the substance of a "gentrification-proofing" agenda that is compatible with the goals of both urbanists and social justice advocates. It will also talk about why too much of cities' existing anti-gentrification policy toolkit is inadequate, inappropriate for its context, or both.

Read the final article in this series: "Calming the Waters: How to Address Both Gentrification and Concentrated Poverty."

(Top photo source: Harold Navarro)

In this episode, Chuck explores the flawed nature of North America’s current “housing bargain,” where most neighborhoods are allowed to stay exactly the same as long as some neighborhoods are forced to radically change. (Transcript included.)