Developers Are Finding Value in Less Profitable Projects

Zack Barowitz is a Strong Towns reader from Portland, Maine. Today, we are sharing a guest post he wrote about efforts to build attainable workforce housing in his city: market-rate homes that fill the gap between new high-end units and subsidized low-income housing.

While there are developers who have gotten rich building low-income housing (the President’s father, among others), today few if any developers take on such projects without public subsidy. In Portland, Maine, however, some established developers are venturing into filling the need for workforce housing without the help of subsidies, even though it is less profitable.

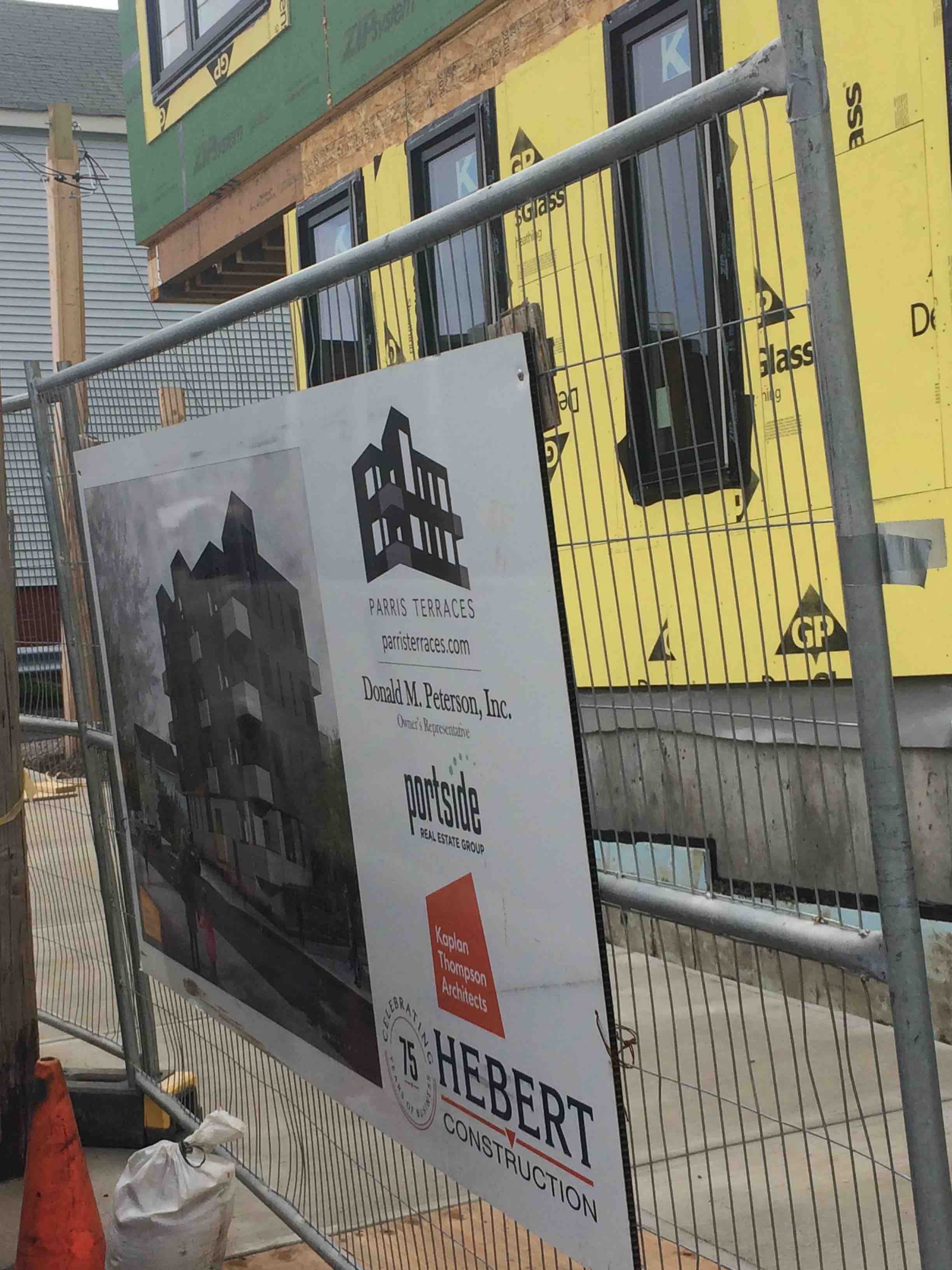

“One hundred years ago people built buildings like this one, but [today] ‘normal buildings’ like this are incredibly hard to pull off and are incredibly rare,” says Jesse Thompson of the firm Kaplan & Thompson. The project that Thompson is working on, 60 Parris Street, is a twenty-three unit condo building built without subsidy, with twenty of the condos (including two inclusionary zoning units) being sold at a price considered affordable for those earning 120% or less of area median income (AMI); this works out to around $220,000 per unit (roughly the average price of a Portland Condo), or a monthly payment of about $1,600 for mortgage and HOA fees.

An evening scene in Portland. Source: Corey Templeton via Flickr.

Portland, Maine is a hot market, fueled largely by the quality of life that the small city has to offer, but also by the fact that, despite rising prices, housing costs are still substantially lower than in larger markets like Boston and New York. But, while housing in Portland is cheaper, wages are lower as well. A $1,600 monthly payment could be afforded by a young attorney, medical resident, pharmacist, IT professional, nurse, or downsizing retiree. But, teachers, service industry workers, administrative office staff, and nonprofit-sector employees would most likely need to double up.

Housing is a Differentiated Commodity

Compared to most other products or services, the economics of housing has some irregular aspects. For starters, only in housing does the largest market (the middle class) get the smallest amount of new product. That is because for a given location, the land, construction, and soft costs are essentially the same no matter what type (low, moderate, luxury) of housing is being built. The main variable distinguishing the higher end of the market, the finishes, is a fairly negligible component of the development cost. Another anomaly about housing is that as production goes up, so do (labor) costs, but quality goes down as the labor market dilutes. Moreover, there are few economies of scale, insofar as it isn’t really cheaper for a developer to take on ten projects instead of one.

And then there is the byzantine world of housing subsidies and finance. Affordable workforce housing (for those earning 80%-120% of area median income (AMI)—the middle class— is a virtual non-starter in much of the country. This is because subsidies are rarely available for these mid-level projects: most are reserved for lower-income households. Conversely, middle-income housing is rarely the most profitable thing that can be built without subsidy; and investors naturally prefer projects with a higher rate of return.

Finding Value in Less Profitable Projects

A scene from Portland’s West Bayside neighborhood. (Source: Zack Barowitz)

60 Parris Street sits in the West Bayside neighborhood of Portland, a downtown neighborhood that has largely been left out of the city’s development frenzy. The developer, Jack Soley, is so keen to point out the exceptionality of a 120% AMI or better project that he talks about it with such zeal that the project could be termed a mission-based development. “This project proves that it can be done . . . . The building and units are identical to luxury housing in every way except for one—unit size; we made the apartments smaller,” says Soley, who bought the land from the City of Portland through an RFP (request for proposal).

West Bayside has been troubled by being the main hub for the city’s social service sector—including a grossly over-burdened emergency homeless shelter. The area is defined largely by the visibility of people with substance abuse problems and associated problems of insobriety, fights, and generally unseemly behavior. While it is not currently a prime location for new luxury construction (or larger family-sized units) the city has been desperate to turn the neighborhood around. “I want this project to be part of my legacy here in Portland,” Soley says.

While Soley’s 60 Parris Street project is profitable, it does not have the margins of the hotels and high-end condos that he is used to building. Another Portland developer, Todd Alexander, is also stepping away from his typical business model, which relies on low income housing tax credits (LIHTC), tax-exempt bonds, and other forms of public financing for low-income housing. He is instead building smaller unsubsidized condominium projects that also fall in, or close, to the realm of ‘affordable market rate.’

One Joy Place during construction. (Source: Zack Barowitz)

One such project is One Joy Place, an eight-unit project on the site of a burnt-out tear-down that was so difficult to move ahead that Alexander spent years just trying to get the previous owner to call him back. “I could have built five high-end town home condos and made a lot more money on the site,” he said. Instead, One Joy’s units start at around $252k, but at 575 square feet, they are a bit bigger than Soley’s apartments at 60 Parris Street. And One Joy is also in Portland’s West End, a more desirable neighborhood. He was able to make the numbers work in part by not offering parking to every unit. This allowed him to “re-purpose” surface parking for living space (although he had to expend considerable energy convincing the planning department and the neighbors of the efficacy of doing so). “I wanted to build affordable units in the neighborhood where I live,” he explained.

Jonathan Culley and Catherine Culley develop both high end projects and rental properties in the ‘upper-affordable’ market through their company Redfern. In Portland, a mid-level affordable rent works out to around $1,300-$1,600/mo. Like Jack Soley and Todd Alexander, the Culleys are building without subsidy, although Jonathan bristles at the suggestion of “social value” development. “We do try to fill a social need, but in order for that work to be sustainable and repeatable, the projects also need to be profitable,” he says.

Indeed, the economics of unit size and of buying vs. renting both beg the definition of affordability, as the standard of “affordable” is already somewhat woolly. A small condo, 425 square feet at $210,000, might be affordable for a single junior associate at a law firm who may prefer to rent anyway. On the other hand, a 700 square foot, $270,000 apartment might be both affordable and livable for a dual-income household each of more moderate income—a nonprofit employee and a relatively well paid service worker, for example.

According to Jesse Thompson, the first one-third of purchasers at 60 Parris are people who are 35 or younger and going from renting to owning and who are used to living in smaller spaces. On the other hand, Alexander’s projects One Joy and West Port Lofts have sold mostly to buyers seeking second homes, investors, and older purchasers. As of this printing, 7 of 12 units at One Joy have sold. Among the unsold are the most expensive unit ($359k) and the inclusionary-zoning unit ($208k), which is deed restricted. [Disclosure: the author is employed at a firm that manages property for both Redfern and Todd Alexander.]

Imperfect Projects in an Imperfect Housing World

These are not perfect projects by any stretch. For starters, even 100% AMI means that the projects are not affordable to the bottom half of income earners, and the effect of a few projects (fewer than forty units) is bound to be negligible in a town of 65,000. One could also quibble with Soley’s assertion that he did not receive subsidy because he paid a low price for the land through a City RFP (Soley counters that the land was distressed and the needed remediation brought the price up to market rate). There is also the question of whether twenty-three first-time owners can self-manage; professional management would add approximately $20 a month to HOA fees.

Part of the attraction of projects like these to developers is that in addition to working without subsidy, they are working within current zoning requirements. But zoning restrictions drive up the price by placing limitations on the size of the buildings, and—more dramatically—so do parking requirements. Roughly two-thirds of the 60 Parris Street site is devoted to surface parking, albeit separately deeded. Owners who want a parking space must pay an additional $12,000, plus a monthly fee is $50. But if the developer had achieved a zone change, and built on all or most of the lot, the number of units might have swelled to 60-75 units. Ultimately, it is difficult to speculate on how much a larger project might have dropped the sale price because most buyers (and renters) require—or think they require—parking, and most neighbors would object to a project without it.

Pushing and Pulling

Christian Milneil, who sits on the Board of Commissioners for the Portland Housing Authority, has another take on why developers are dipping into the middle market:

“Most of what's been built in the past ten years has been for the higher end of the market, and that segment is pretty saturated now, especially given how we're in Maine, which is not a wealthy state. There are several projects aiming for that high end of the market that have been approved at the planning board but haven't been able to move forward with construction, presumably because they aren't pre-selling enough units at prices that would pay off their construction loans.”

Milneil, who takes an orthodox view of economics, sees market forces—rather than developer consciences—as the driving force behind these projects.

“There's tremendous demand for mid-market housing and until recently developers haven't been addressing that market segment at all. So I don't look at projects like 60 Parris or One Joy Place as examples of developer altruism; it's just an example of how smart developers who are willing to build more affordable homes are going to have an easier time finding customers in this environment.”

If that is the case, then we might be seeing a form of filtering, at least when it comes to new construction. Historically, the availability of workforce housing has been largely a matter of filtering. This is the conventional wisdom in economics which states that simply adding to the housing supply can lower the price of older and previously higher-end housing (thus the “filter”).

That process appears to have stalled in certain hot markets. The perception, at least, is that when demand is strong on the high end, more and more units are produced for that market segment via new production, conversion, and renovation. However, in Portland, as in other markets, the high-end of the market has remained so strong that prices have not dropped despite the increase in supply and many older units are being gentrified. Those hoping to get a decent deal because of increased supply are being unrealistic, says Thompson, because “The system is broken all up and down the line.”

Perception Problems

Whether this upward pressure is finite or not, fast rising prices, have left many Portland residents suspicious of development of any kind, and they can be quite vocal when it comes to their assessment of housing prices.

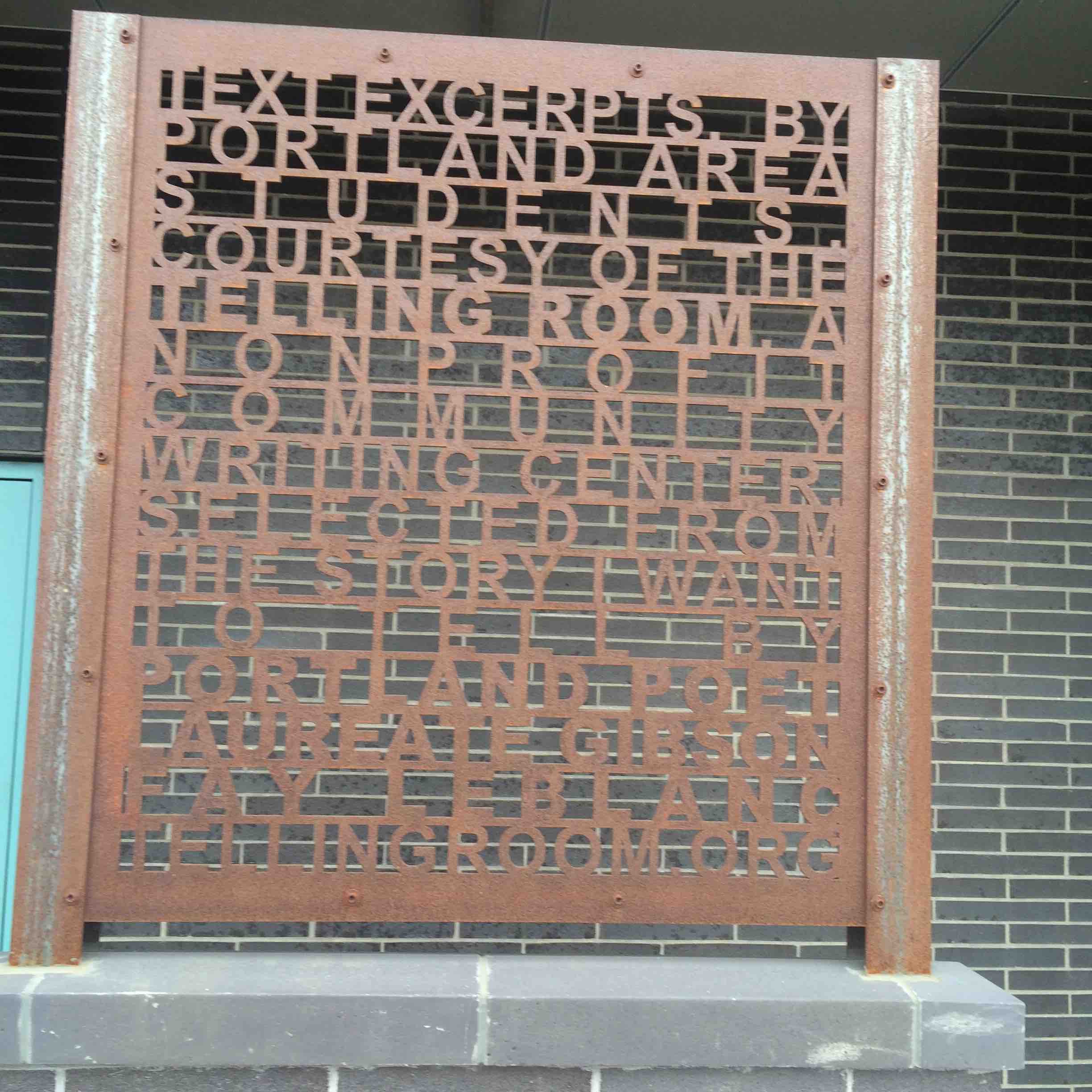

Community pushback is a powerful force. Often, well-meaning neighbors will lament the high cost per square foot of new development, or the strain it imposes on on-street parking, without acknowledging that there are few options for building (relatively) affordable units that don’t involve some burden being shifted to taxpayers. Furthermore, it is not necessarily widely perceived that compact, walkable, and transit-oriented development builds stronger neighborhoods. Additionally, Thompson tells me that much of the pushback that they received was concern that people would sell or “flip” their units in a matter of three or four years—but is that a problem? “I’m not sure why only people in their 50s, 60s, and 70s should be allowed to build equity in their housing,” Thompson asserts. “Why can’t people do that in their 20s, 30s, and 40s?”

In most urban neighborhoods around the country (never mind suburban and rural communities), single family homes are still the predominant housing type. This is helped along by preferential tax treatment: even in New York City, single family houses are taxed at a much lower rate than higher-density condominiums. In Portland, most new luxury condos tend to be built in the “townhome” style (rather than flats or floor-throughs). “A townhome is more like a single family house, which is what most buyers around here want,” says Alexander. Perhaps this is because people tend to equate houses with “homes,” while apartments are rentals. (Incidentally, townhome-style units tend to be cheaper to build than multi-units, which may require steel, bigger contractors, and more complex designs.)

A triple-decker: a type of Missing Middle housing common to Portland and other New England cities. (Source: Wikimedia Commons)

But this was not always the case. Portland, like many other new England cities, is full of triple-deckers, or “Portland 3s.” These are three large family-sized floor-through units built out to nearly the full lot but still at human scale. They serve well as owner-occupied or investment properties. Unfortunately, zoning setbacks and unit costs no longer make this type viable for workforce housing–but still the precedent is there.

Ultimately, it may come down to a matter of perception. It could be that young couples living anywhere outside of a few large cities might not perceive an apartment as an appropriate place for a married couple, or at least less desirable than a single family house. (It is OK for single people or even unmarried couples who rent.) In real estate ads and on home shows, the cozy word “home” has replaced the basic noun, “house” for freestanding residences—“townhome” as opposed to “townhouse” [thankfully my spell check accepts the latter and not the former]. Maybe if apartments could edge into being called “apartomes,” they would satisfy Jesse Thompson’s conclusion: “We need more than just ‘starter homes’ in this town, we need starter apartments.”

(Cover photo: Corey Templeton via Flickr.)

About the Author

Zack Barowitz is a property manager in Portland Maine. In his spare time he attends city and neighborhood meetings. Zack's monthly column Urban Conditional appears in the Portland Phoenix. His website is ZacharyBarowitz.com.

Texas isn’t exactly known for its housing shortage, but continued affordability isn't guaranteed. That's why lawmakers across the aisle are trying to get ahead with a new bill.