Strong Towns advocates do impressive analyses of their towns’ math. They create value per acre maps, calculate whether cul-de-sacs are fiscally solvent and look at how vast a town can be before it is fiscally unsound and what lot widths are required to be a solvent city. That’s intimidating quality.

I've stood in public hearings and said that cities across North America are functionally insolvent, or at least living a soft default. But how would I know if that was true in my hometown of Calgary, Alberta, Canada? How could I prove it?

Charles Marohn has suggested cities should focus less on density as an objective and more on the ratio between private investment and public investment. Traditionally, private investment led to public investment. Private investment is essential to maintaining public infrastructure. Marohn thinks financially stable cities should strive for “a target ratio of private investment to public investment of somewhere between 20:1 on the risky end and 40:1 on the secure end.”

After reading Michel Durand-Wood’s blog, I decided to calculate that ratio for Calgary. A follow-up article tomorrow will analyze what I found for Calgary. Here’s how you can do the math for your town or city:

Step 1. Find your town’s property assessment and infrastructure information

For private investment, we can use the total value of the City’s property assessments. The City of Calgary’s primary revenue source is property taxes, which are based on property assessments. A small amount of revenue also comes from user fees. Provincial law prevents other municipal taxes and that isn’t likely to change. For public investment, we can use the City’s total asset value from the latest infrastructure report (ignoring whether infrastructure is an asset or liability). Those values may not be perfectly equivalent to the total private and public investment. Businesses have value beyond their property. Other levels of government may build and maintain infrastructure like hospitals, schools, courts, highways, or parks. We need to start somewhere, and these numbers are close enough for our purposes, so we’ll use them.

Calgary’s most recent infrastructure status report is as of January 1, 2017. We’ll use the property assessments from 2016 and 2017 so we don’t have to factor in inflation.

Step 2. Find your private to public investment ratio

Calgary’s property assessments are based on July 1st. Taking an average of the 2016 and 2017 property assessment ($303 billion and $311 billion, respectively), we can estimate that private property was worth $307 billion on January 1, 2017, the same day that Calgary’s infrastructure was valued at $84.7 billion (Note: All values are in Canadian dollars. For reference, on January 1, 2017 $1 Canadian was equivalent to about $.74 USD. On Friday, February 19, 2021, $1 CAD was equivalent to $.79 USD.)

Private investment ÷Public investment

$307 billion / $84.7 billion = 3.6:1 private to public investment ratio.

To put that as a percentage, Calgary’s infrastructure is worth 27% of the private property in town. In a city with a private to public investment ratio of 20:1 to 40:1, infrastructure would be between 2.5% to 5% of the private investment.

If we allocated the infrastructure costs evenly among people based on property value, someone with property assessed at $360,000 would have a “share” of our infrastructure of $100,000. The median detached home in Calgary (averaged between July 2016 and July 2017) was worth $470,000; the median residential condo was worth $265,000. Their “share” of public infrastructure is $130,556 and $73,611, respectively ($470,000 / 3.6 and $265,000 ÷ 3.6).

Step 3. Find out how much money the city should collect each year

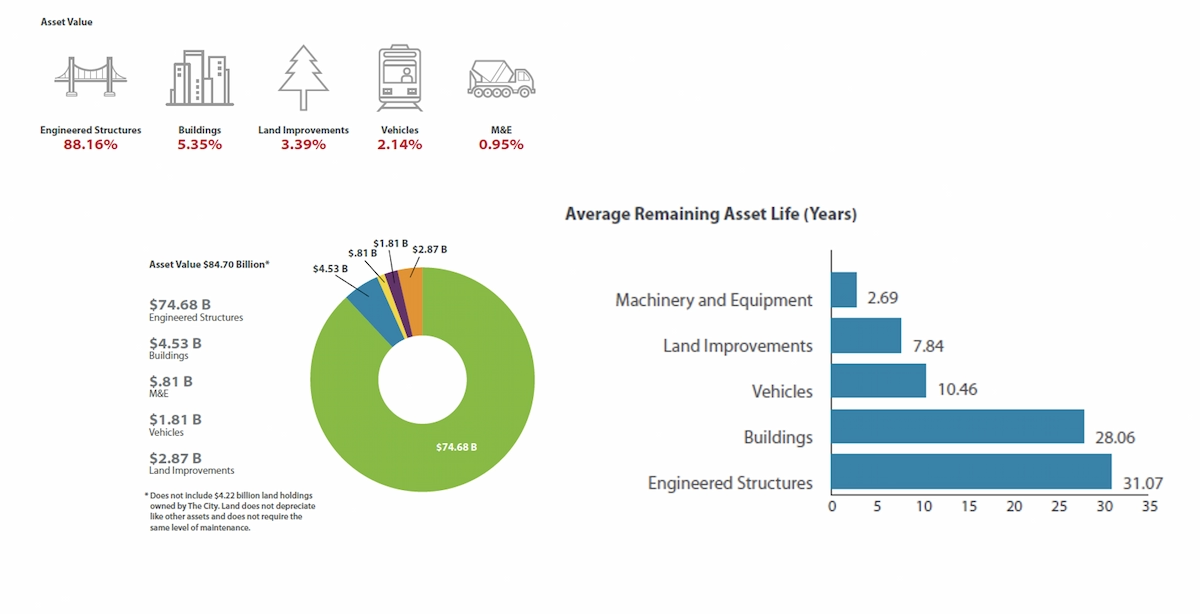

Cities, like homeowners saving for their inevitable roof repair, could collect or save enough money each year to prepare to replace their infrastructure when its lifespan ends. As these figures from pages 15 and 17 of our infrastructure status report shows, the City manages $84.7 billion of infrastructure. How much should we be saving annually to make sure we can replace that infrastructure when the time comes?

If we divide our infrastructure’s replacement value by the number of years remaining before we need to replace it, we can know how much to save each year. Let’s call that the annual cost. Ideally, the City’s infrastructure report would include the value and remaining life for each asset type by business unit. It doesn’t. Given the available information, we’ll use the information grouped by asset type from pages 15 and 17 from the infrastructure report.

Therefore, Calgary needs to collect $3.41 billion annually. This is almost the same value as if we assumed a 25-year asset life ($84.7B / 25 years = $3.39B/year), which is reassuring if you don’t have more information than your city’s the total infrastructure value.

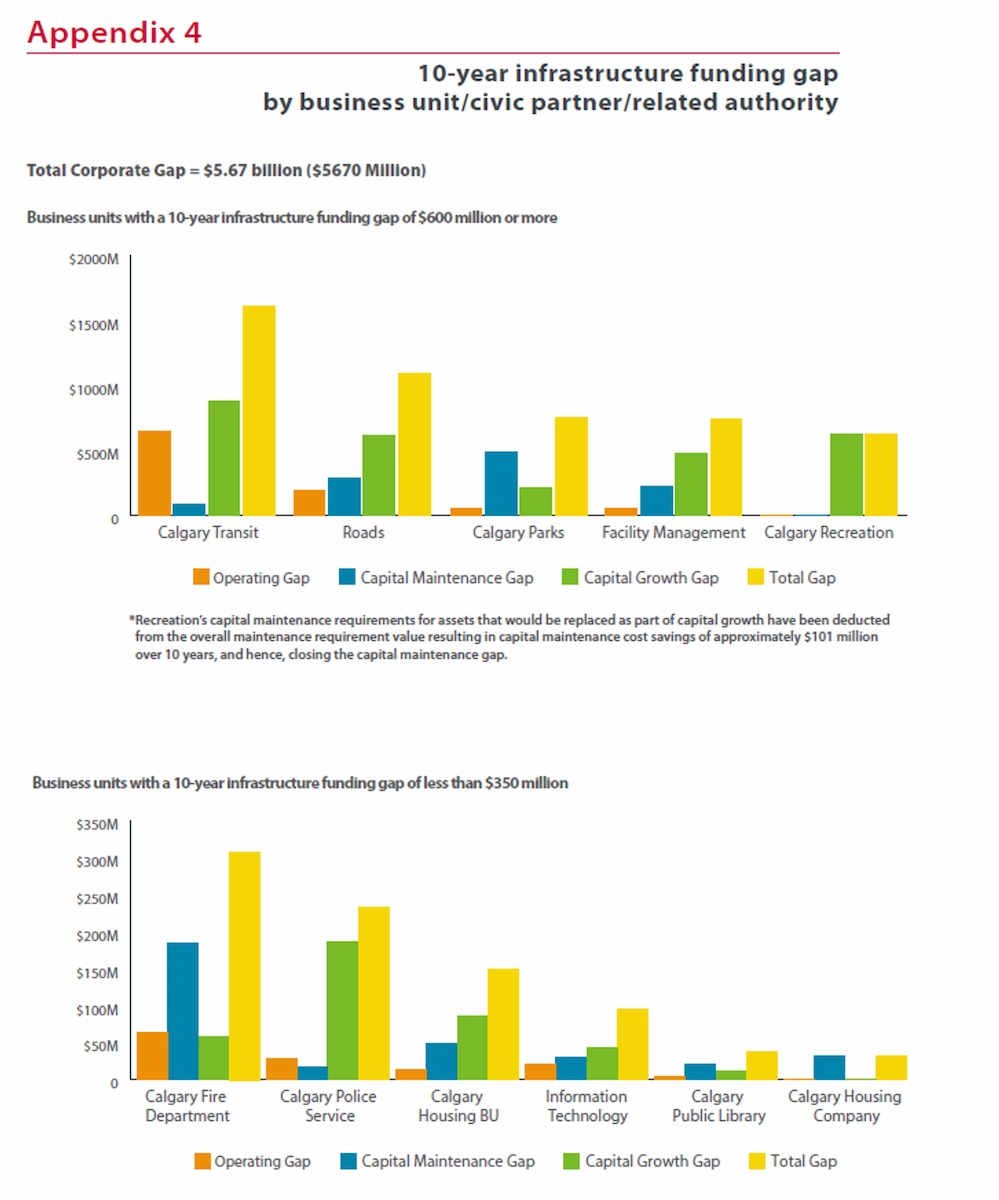

Perhaps we can bring that number down by vigilantly maintaining our infrastructure to extend its lifespan. This could be done by repairing or coating cracks in concrete bridges, painting metal bridges and installing liners in existing pipes. We need to focus on extending lifespans through maintenance because, even in 2017, when 88% of Calgary’s infrastructure was in good to very good condition, the infrastructure report said we had an “infrastructure gap” (meaning unfunded liabilities) of $5.67 billion over the next ten years, as shown at right. Presumably, budget cuts since then have let our infrastructure’s condition decline and infrastructure gap increase.

Philip K. Dick wrote, “Reality is that which, when you stop believing in it, doesn’t go away.” Our frightening reality is that if Calgary is going to maintain its infrastructure, it needs to collect $3.41 billion, in 2017 dollars, every year—good, bad or pandemic-filled—forever.

Step 4. How much would people need to pay each year?

Now we can find out how much people need to pay. Yes, we can divide the total annual cost from step three by the population, but that assumes everyone alive pays for infrastructure. Instead, let’s find how much people should pay for every $100,000 of private property.

Annual cost per $100,000 of private property = Total Annual Cost × ($100000 / Total Private Investment)

= $3.41 billion per year × ($100000 ÷ $307 billion)

= $1,111 per year per $100,000 of private property

Someone in Calgary’s median detached home assessed at $470,000 would have an annual “share” of $5,222 ($1,111 x $470,000 / $100,000). It’s $2,944 for someone in the median condo ($1,111 x $265,000 / $100,000). Yet the tax bill for someone in the median detached home in 2016 and 2017 averaged to $1,848. We would need to increase our taxes by 2.8 times ($5,222 / $1,848 = 2.8) just to maintain our infrastructure, and that doesn’t even include operating essential services. (If you've been doing the math along the way, you may find that our numbers differ by a few dollars. It depends on whether you've carried those numbers along from each previous step, but it's close enough for our purposes.)

As a report recommending the amalgamation of two towns near Calgary put it directly, “The growing need for funding to address infrastructure deficits and replacement needs is colliding with either a shrinking, or a peaked ability to generate revenue. The ability to tax our way out of these challenges is no longer possible."

Step 5. Look for bonus information

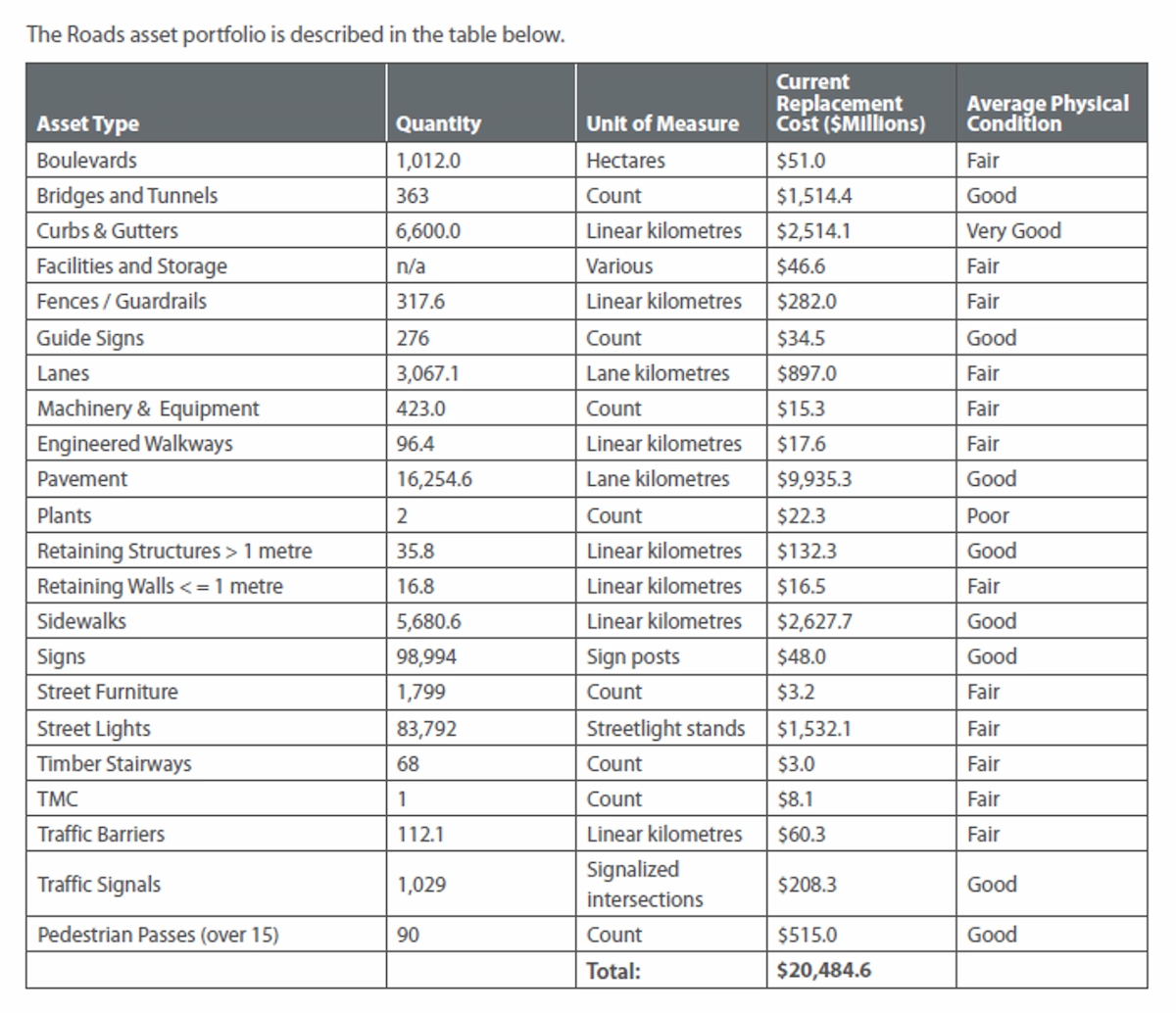

Your city’s infrastructure report may have other useful information. For example, Calgary’s appendix (page 59) includes a table about the quantity and replacement costs of Roads’ assets. With 16,255 kilometres of pavement worth $9.935 billion, the average cost of pavement (from collectors to cul-de-sacs) in Calgary is $611,230/km. Talking to developers, the price has gone down since 2017, but that’s still a useful number for those of us who may not be able to use the US Federal Highway Administration’s numbers.

Tomorrow, in the second half of this piece, we’ll look at how Calgary has kept this going so long, at the city’s fragility and how Calgary can become more productive if we’re going to have a more stable public to private investment ratio.

ADDENDUM (April 28, 2021)

Humility is a key principle of Strong Towns. When someone reminded me that Water Resources’ user fees are designed to cover the replacement costs of our water infrastructure, I realized I needed to do the math again to stop counting those costs twice.

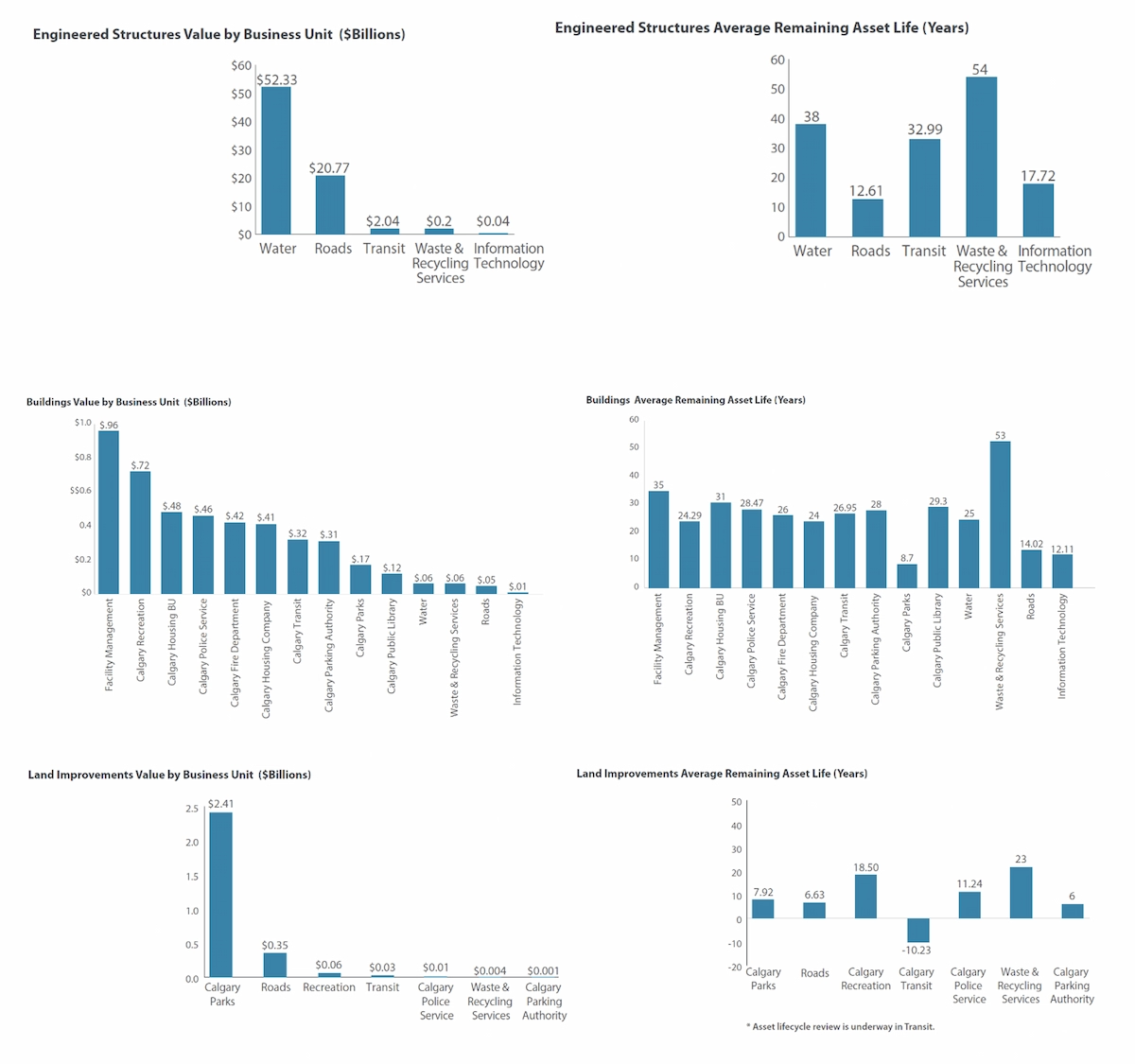

Fortunately, section 4 of Calgary’ infrastructure report gives a breakdown of assets by asset category for each business unit. We can use the data from pages 25-34 to repeat the math in step 3. Here are some of the charts:

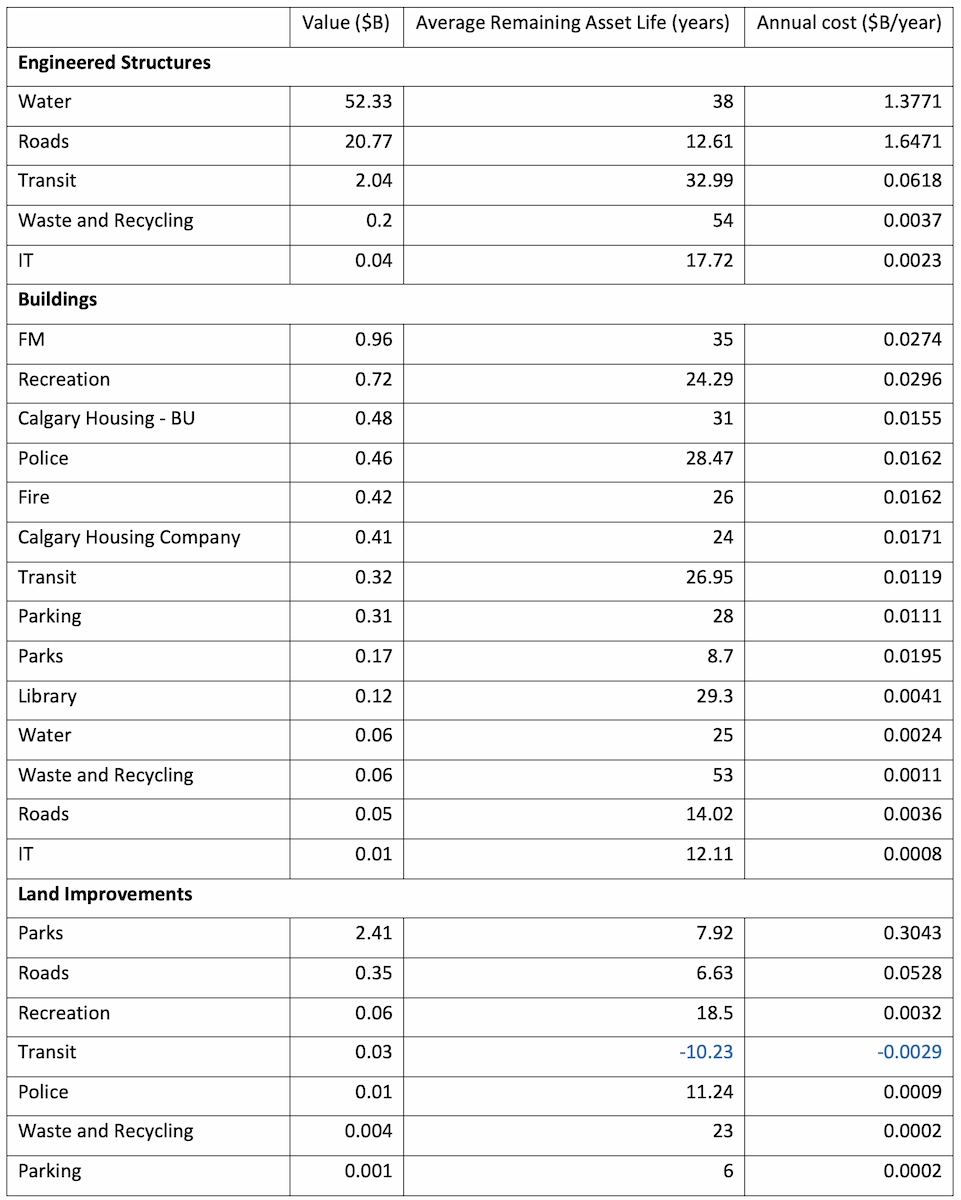

Dividing the value for each asset category and business unit by the average remaining asset life produces this table, from which we’ll subtract the annual cost of Water’s engineered structures and buildings.

This information is more precise, so it produces a total of $4.36 billion/year. After removing Water’s engineered structures and buildings, it’s $2.98 billion/year.

There are a few things that should be pointed out. Transit has some land with a negative asset life. The report says “a negative useful life doesn’t always mean the asset requires replacement.” The $2.9 million annual cost produced by that negative number is a small portion of the total annual cost of $4.36 billion/year. But I subtracted it from the total simply because I’m not sure how to count land that appears to have been in need of some work since 2007.

It's also educational to see what business units’ asset categories have the five highest annual costs:

- Roads’ engineered structures: $1.65 billion/year

- Water’s engineered structures: $1.38 billion/year

- Information Technology’s machinery and equipment: $391.5 million/year (computers have short lifespans)

- Parks’ land improvements: $304.3 million/year

- Transits’ vehicles: $113.8 million/year

Now we can repeat step 4 by finding how much the City would need to collect every year if we shared that responsibility evenly based on private property’s assessed value. That would treat all private property the same, whether it was residential, commercial, or farmland–yes, there is farmland in Calgary’s city limits.

Annual cost per $100,000 of private property = Total Annual Cost × ($100,000 / Total Private Investment)

= $2.98 billion per year × ($100,000 / $307 billion)

= $971 per year per $100,000 of private property

Let’s find the annual “share” for someone in Calgary’s median detached home ($470,000) and median condo ($265,000):

= $971 x $470,000 / $100,000

= $4,564 for the median detached home.

= $971 x $265,000 / $100,000

= $2,573 for the median condo.

And we can compare that hypothetical value with actual residential taxes:

= $4,564/$1,848 = 2.5

When we exclude Water Resources’ infrastructure, which should be replaced by user fees, it turns out Calgary isn’t in as bad of a spot. Instead of increasing residential taxes by 2.8 times, we’d only need to increase them by 2.5 times. We’re still in a hole, it’s just not quite as deep. In either case, we’d still need to more than double our residential taxes just to cover our infrastructure’s replacement costs.

.webp)